Nobody goes there anymore. It’s too crowded.

— Yogi Berra

I first heard of index funds in the 90s, although they had been around since 1975. Their popularity grew relatively slowly at first, but has skyrocketed in the last 20 years or so.

A number of factors have contributed to this growth, but one of the biggest has been the steady trend away from defined-benefit pensions to defined-contribution retirement plans like 401(k)’s. These plans typically offer limited choices, most often comprising a defined set of mutual funds to choose from. As word got out that few managed funds could consistently outperform the indexes (a point I certainly do not dispute), it’s no surprise that more and more Americans have elected to invest their retirement savings in them.

Millions upon millions of people now steadily pour money into index funds every month. While it’s great that so many people have figured out that it’s a good idea to avoid the high fees and spotty performance of actively managed mutual funds, this also presents a problem.

The Crowd Ruins Everything

The trouble with great investment ideas is that they almost always contain the seeds of their own destruction. In anything resembling an efficient market, as soon as word gets out about any edge that can be gained, hordes of people pour in and shift prices until the edge disappears.

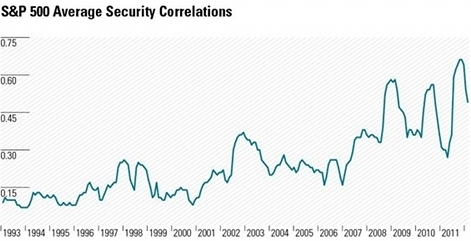

I hate to say it, but I’ve come to suspect that index investing is no exception. To see why, have a look at the following chart: 1

This chart shows correlation levels among the stocks that make up the S&P 500 index since 1993. Correlation essentially measures the extent to which stocks move together as opposed to independently.

During period the chart covers, the percentage of all U.S. equity assets being passively managed grew from roughly 10% to about 30%. As you can see, during the same period, correlations have trended steadily upward, hitting all-time highs over the past couple of years.

This is hardly surprising, when you think about it. Almost a third of all equities in the market are now bought and sold in massive quantities, all together, based on absolutely no analysis whatsoever of their individual worth. That is, after all, what index investing is. And when all stocks in an index are bought and sold together, the natural result is that their prices will tend to move together.2

Not Your Father’s Diversification

One of the biggest selling points of index funds is the great diversification they provide. Diversification helps mitigate risks, lowers volatility, and smooths out returns, at least in theory. Unfortunately, that all starts breaking down when correlations rise. The more stocks move together, the less protection from volatility buying them all at once provides.

Does that mean diversification no longer has any benefit? Of course not. But the same level of diversification offers much less protection now than it used to. In my mind, that raises a question: What would happen if everyone invested exclusively in index funds?

Well? What do you think? What would happen?

I will leave you with a story to reflect on. It’s called the Parable of the Ox. Read it, and see what ideas it gives you.

See you next time.

- Source: SSgA by way of Seeking Alpha. ↩

- I don’t claim that the rising popularity of index investing is the sole cause of this trend, but it would be difficult to argue that it isn’t a major factor. ↩

14 Comments