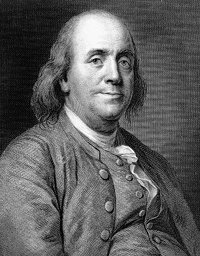

Lost time is never found again.

—Benjamin Franklin

Time is money. You’ve heard it a thousand times, and it makes sense. But have you ever considered it the other way around? After all, if time is money, then money must be time. It may seem like an odd concept, but as it turns out, the analogy holds up quite well. More importantly, thinking of money in terms of time is one of the best ways to adopt a more healthy attitude about spending vs. building wealth. Read on to find out how.

Your True Hourly Wage

If you presently work at a job, the best way to begin thinking of money in terms of time is to figure out your true hourly wage. I was first introduced to this concept in the classic personal finance book Your Money or Your Life, by Vicki Robin and Joe Dominguez (which I highly recommend you read). The idea is to figure out how much income your job is really bringing in, once you factor in all the costs both in time and money of having a job in the first place. I must warn you — you should prepare to be shocked by the answer.

Figure Out Your Real Working Hours

First, figure out how much time you really spend on your job. The rule to follow here is to factor in every last thing you currently do that you wouldn’t do if you didn’t have to work for a living. Here’s a partial list of some things to consider.

- All hours spent at or around the office, including time actually working, unproductive “face time,” lunch breaks, overtime, etc.

- Your commute

- Time spent shuffling kids back and forth to daycare

- Business Travel

- Job Training

- Time spent shopping for work supplies, clothes, etc.

- Seminars and conventions

- Time spent working or thinking about work at home

- Time spent “unwinding” from work at the local bar

Remember, this is just a partial list to help you get started. Your real list will likely be longer. Average out everything on a weekly basis to figure out how much of your precious time your job is really costing you.

Add Up Your Work Expenses

Now, figure out how much money you spend on your job. Again, include every last penny that you wouldn’t generally spend if you didn’t have to work for a living, and average it out per week. Here are some possibilities to consider:

- Commuting costs

- If you drive, the IRS mileage deduction of 51 cents per mile is a reasonable approximation that includes gas and maintenance costs.

- If you wouldn’t need a car if it weren’t for your job, include the cost of the car itself as well, along with taxes and insurance.

- Parking

- Daycare costs

- Happy hour

- Licensing costs

- Training expenses

- Restaurant lunches

- Coffee

- Work clothes

Compute Your Real Hourly Wage

Now take your weekly take-home pay, after all taxes. You can add back any 401(k) contribution you may be making, but be sure to subtract taxes from that as well. Now subtract all the expenses you computed above. This is your real weekly income.

Now divide your real weekly income by the number of hours you computed earlier. The result is your real hourly wage — the real amount of money you’re receiving for all the precious, irreplaceable time you put into your job, week after week, year after year. Like I said before, prepare to be shocked by the figure.

A Typical Example

To illustrate how you can put this knowledge to use, let’s consider a typical American worker. Let’s call him Bob. Let’s say Bob earns a near average income of $40,000 per year. Assuming he works 50 weeks per year, that comes to an even $20 per hour — or so he thinks.

The average federal tax burden for such a worker is about 14%, and the average state tax is about 7%. That comes to 21%, or about $162 per week.

Now let’s add in the commute. The average U.S. worker’s commute is about 15 miles, taking about 25 minutes. Using the IRS mileage cost of 51 cents per mile, that comes to about $38 and 4 hours per week. Let’s also add in $5 per day for parking.

Now let’s factor in food. Let’s say a restaurant lunch at $10 and 1 hour, one gourmet coffee at $3, and one weekly happy hour at $20 and 1 hour. All very typical.

Finally, let’s assume he works 45 hours, as the current prevailing trend among salaried employees is to work more than 40 hours per week.

| Item | Expense (weekly) | Hours (weekly) |

|---|---|---|

| Working | — | 45 |

| Taxes | $161 | — |

| Commute and Parking | $63 | 4 |

| Food and Drink | $85 | 6 |

| Total | $309 | 55 |

Taking his weekly wage of $769, that gives Bob a real wage of only $8.36 per hour! That means that each dollar Bob spends costs him more than seven minutes at work.

A New Perspective

Now let’s put some of Bob’s expenses into perspective. Bob knows that eating lunch out costs a lot more, but he does it because it “saves time.” But does it really? That $10 lunch costs him over an hour of time on the job. He could prepare lunch for an entire week in less time than that — never mind that he could save upwards of $40 in the bargain.

Similarly, that daily coffee costs him about 22 minutes on the job. I’ll bet making coffee at home would take a lot less time, and he could put that $3 back in his pocket as a bonus.

How about that weekly happy hour Bob attends to unwind? That costs him almost two and a half hours, week in, week out. Perhaps Bob should reconsider this expense. Perhaps he will, when he sees it in this light.

Now let’s say Bob decides he wants an Xbox 360. He’s wisely waited a few years since they were released, so the price has gone down to a mere $199. The thing is, that $199 will cost Bob nearly 24 hours, or almost three full days of work. That’s three more days away from his family, friends, and the things he loves — three more days before he becomes financially independent and can spend his days any way he likes.

Imagine spending three days at the office, and being handed only an Xbox at the end — not a dime toward rent, food or anything else you truly need. You’d have to spend another 7 hours on the job just to buy your first game.

Keep Your True Hourly Wage in Mind Whenever You Spend

Now you can see — money really is time. So next time you’re debating whether or not to buy something that you may or may not really need, try thinking about the cost in terms of time. Think about how much longer you will have work to get to your goal of financial independence if you make this purchase. Now decide if it’s really worth it.

16 Comments