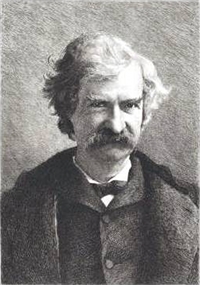

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

—Mark Twain

Consider a series of coin flips. We’ll give heads a value of 1, and tails a value of 0. After 10 flips, we get an unsurprising result — 5 heads and 5 tails. The average value of each flip is 0.5, which happens to match the expected value, as statisticians would call it.

Of course you’d never actually “expect” any particular coin flip to have this value, for the simple reason that it’s impossible. It’s a simple example, but the point behind it is an important one — an average result is not necessarily a typical one.

If you recall, in part I of this series, we learned about the CAGR metric. It is considerably more accurate than the simple “average” return. But recall also what CAGR stands for: Compound average growth rate.

There’s that word again. Average. Does its presence arouse your suspicion by now? It should.

It’s Not so Easy to Be Average

It turns out there’s one pretty big problem with using the CAGR — it assumes the stock market has the same return every year along the way, instead of bouncing all over the place like it really does.

This all works out in the end if you invest your entire sum up-front, but that’s not how it works for most people. Most invest bit by bit over time. As the market moves up and down, you will buy some at higher prices, some at lower. The end result is that your final effective return over a given period is likely to be significantly different from the CAGR.

In the Long Run, We’re All Dead

The conventional wisdom is that this all averages out in the long run. The question is, how long is the long run? 20 years? 30? As it happens, it tends to be longer than most people think. Longer than you have, more than likely.

This can cut either way, of course. If you happen to spend much of the early part of your career in a down market, for example, and ride a bull market up for the final few years before you retire, you may well do far better than the CAGR over the period. This is because most of your investments were made at low prices, and most of your invested funds received the full benefit of the bull run at the end.

But what if, on the other hand, you buy all the way up during one of the greatest bull markets in history, but find that the market had a negative real return over the last decade of your career?

As it turns out, this is precisely what has happened to the baby boomers, who began turning 65 in 2011. So what would have happened if a boomer had followed the plan laid out in part I?

We cannot know precise figures without knowing the exact days our hypothetical boomer invested and the prices paid, but we can make a reasonable estimate by considering each annual $1200 investment separately, using the CAGR from the year it was made through 2011.

The figures are in the following table:

| Year | CAGR through 2011 (source) | Years Invested | Inflation(source) | Real Value of $1200 Investment | Real Final Value of Investment |

|---|---|---|---|---|---|

| 1968 | 4.77% | 44 | 4.27% | $1200 | $9324 |

| 1969 | 4.74% | 43 | 5.46% | $1148 | $8415 |

| 1970 | 5.23% | 42 | 5.84% | $1086 | $9241 |

| 1971 | 5.41% | 41 | 4.3% | $1022 | $8869 |

| 1972 | 5.27% | 40 | 3.27% | $978 | $7635 |

| 1973 | 5.03% | 39 | 6.16% | $946 | $6418 |

| 1974 | 5.85% | 38 | 11.03% | $888 | $7706 |

| 1975 | 7.25% | 37 | 9.2% | $790 | $10532 |

| 1976 | 6.69% | 36 | 5.75% | $717 | $7385 |

| 1977 | 6.37% | 35 | 6.5% | $676 | $5873 |

| 1978 | 7.03% | 34 | 7.62% | $632 | $6371 |

| 1979 | 7.33% | 33 | 11.22% | $584 | $6031 |

| 1980 | 7.41% | 32 | 13.58% | $518 | $5109 |

| 1981 | 7.08% | 31 | 10.35% | $448 | $3736 |

| 1982 | 7.83% | 30 | 6.16% | $401 | $3857 |

| 1983 | 7.53% | 29 | 3.22% | $377 | $3096 |

| 1984 | 7.16% | 28 | 4.3% | $364 | $2530 |

| 1985 | 7.36% | 27 | 3.55% | $349 | $2376 |

| 1986 | 6.65% | 26 | 1.91% | $336 | $1796 |

| 1987 | 6.23% | 25 | 3.66% | $330 | $1497 |

| 1988 | 6.44% | 24 | 4.08% | $318 | $1424 |

| 1989 | 6.22% | 23 | 4.83% | $305 | $1223 |

| 1990 | 5.39% | 22 | 5.39% | $290 | $922 |

| 1991 | 6.13% | 21 | 4.25% | $274 | $959 |

| 1992 | 5.18% | 20 | 3.03% | $263 | $723 |

| 1993 | 5.21% | 19 | 2.96% | $255 | $670 |

| 1994 | 5.1% | 18 | 2.61% | $247 | $606 |

| 1995 | 5.5% | 17 | 2.81% | $241 | $599 |

| 1996 | 3.91% | 16 | 2.93% | $234 | $433 |

| 1997 | 2.97% | 15 | 2.34% | $227 | $353 |

| 1998 | 1.19% | 14 | 1.55% | $222 | $262 |

| 1999 | -0.55% | 13 | 2.19% | $218 | $204 |

| 2000 | -1.95% | 12 | 3.38% | $214 | $169 |

| 2001 | -0.97% | 11 | 2.83% | $206 | $186 |

| 2002 | 0.36% | 10 | 1.59% | $200 | $208 |

| 2003 | 3.52% | 9 | 2.27% | $197 | $270 |

| 2004 | 0.97% | 8 | 2.68% | $193 | $209 |

| 2005 | 0.09% | 7 | 3.39% | $188 | $189 |

| 2006 | -0.11% | 6 | 3.24% | $181 | $181 |

| 2007 | -2.52% | 5 | 2.85% | $175 | $155 |

| 2008 | -3.47% | 4 | 3.85% | $170 | $148 |

| 2009 | 11.45% | 3 | -0.34% | $164 | $227 |

| 2010 | 5.77% | 2 | 1.64% | $164 | $184 |

| 2011 | -1.13% | 1 | 3.16% | $162 | $160 |

The final result for our unfortunate boomer is $128,463 — a good bit lower than the $149,806 he would have wound up with had he managed to earn the historical 6.26% CAGR, and growing ever more distant from the $1 million we were originally promised in part I.

Of course even these figures are suspect, since they assume the boomer in question invested their $1200 in a lump sum every year on January 1. What if he had invested $100 per month instead? Once again, it could cut either way, but the odds are the outcome would have been worse still. (I leave finding the precise answer as an exercise for the reader.)

Never Trust in Averages

I hope you are beginning to see the pitfalls inherent in relying on oversimplified figures and estimates based on historical results. Real life has a way of working out differently. Averages can be useful for making estimations and weighing alternatives, but they can hide all sorts of dangerous assumptions. You must never lose sight of their shortcomings.

Your plans must be tailored to the real world if you wish to have a realistic chance of seeing the results you desire. And if conditions change, you had best be prepared to adjust your plans along with them.

This is starting to get depressing, isn’t it? Well I hate to break it to you, but I have one more post of bad news to go. After that, we’ll start looking into actions you can take.

Note: This time we are able to adjust our contributions for inflation as well as the returns, as we know the time period in question. We must rely on the imperfect CPI for this, despite the warning in part II, as we have no real person for whom we can model actual cost of living, but it will serve for this discussion.

11 Comments