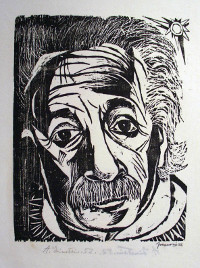

We act as though comfort and luxury were the chief requirements of life, when all that we need to make us happy is something to be enthusiastic about.

— Albert Einstein

Any good plan requires a goal. Today we’re going to begin a series on setting a goal for your finances. If you’re reading this, chances are your eventual goal is, stated simply, becoming financially independent. That is, after all, what this site is all about. It’s only natural — everyone wants financial freedom, right? Well I have one question for you:

Why?

It’s a simple enough question. Yet few people ever ask it, perhaps because they believe the answer is so obvious. Surely we all know the reasons to seek out financial independence, don’t we?

Or do we? I wonder. [Click to continue…]